Investments

FFTC Investment Pools and Performance

Foundation For The Carolinas offers a cost-effective, expertly managed investment platform designed to address the diverse needs and objectives of those we serve. Fund advisors can choose from a number of investment strategies to increase diversification, lower costs and gain access to top-quality managers. Together, we will leverage our expertise and sound financial management to maximize your investment in the community.

Dependable Stewardship

FFTC’s Investment Committee believes the most important investment decision is the asset allocation decision. Our approach to asset allocation is based on developing the appropriate mix of investments that address a portfolio's long-term growth while maintaining an acceptable level of risk and protection against inflation.

Our offerings are strengthened by the expertise of our Investment Committee, appointed by FFTC’s Board of Directors and comprised of veteran investors and experienced business leaders. The Investment Committee determines asset allocation and monitors market performance with the goal of achieving a return commensurate with the risk of the particular investment portfolio and manager strategy.

Current Investment Committee

Bill Martin, Chair, Nuveen (retired)

Michael Fischer, CFA®, Bank of America Private Bank (retired)

Rhondale Haywood, Truist

Meredith Heimburger, Global Endowment Management

Kelly Katterhagen, BlackArch Partners (retired)

Marina Mavrakis, TIAA (retired)

FFTC retains an Investment Consultant, currently Mercer LLC, specializing in institutional funds management to help guide the Investment Committee. The Investment Committee has delegated the responsibility for selecting, monitoring and terminating investment managers. Mercer is also responsible for reviewing and reporting investment performance across all FFTC standard pools to ensure long-term performance achieves the investment objectives of the different strategies. The consultant also provides support and recommendations concerning capital market conditions, asset allocation and portfolio risk. Mercer is a fiduciary with respect to its investment advisory relationship with FFTC.

In addition to the Investment Consultant, FFTC’s internal staff includes investment professionals who further assist the committee in monitoring all aspects of FFTC’s investment portfolios.

Investment Pools To Meet Your Needs

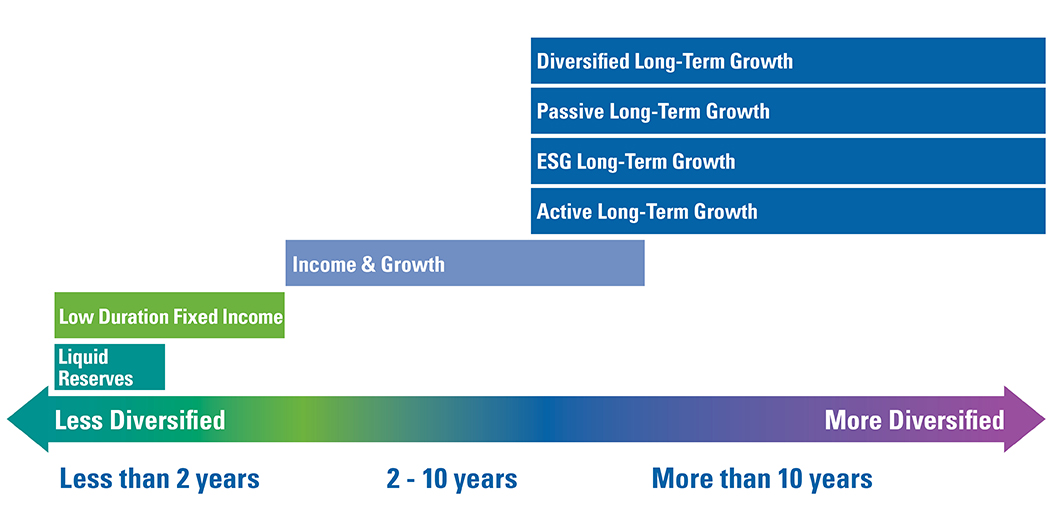

FFTC offers a robust array of investment options designed to match your fund objectives, time horizon and risk tolerance. Investment pool options are available based on the size and type of your fund.

To request past investment reports, please contact us at investments@fftc.org.

Anticipated Distribution Horizon (in years)

The Liquid Reserves Pool is invested in the Vanguard Treasury Money Market Fund. The fund seeks as high a level of current income as is consistent with liquidity and stability of principal. TempFund invests in a broad range of U.S. dollar denominated money market instruments.

The Low Duration Fixed Income Pool is a low-volatility strategy with an objective to preserve capital while generating income. Investments include a variety of fixed income instruments with maturities generally less than five years – approximately three years on average.

The Income & Growth Pool is designed to yield consistent income and dividends while also achieving moderate capital appreciation. The portfolio is allocated 60% fixed income and 40% equity. The equity allocation includes domestic, international developed and emerging market large and small cap equity securities. The fixed income allocation includes short and medium term fixed income securities with an aggregate maturity of six years.

The Active Long-Term Growth Pool seeks long-term capital appreciation without exposure to hedge funds or private equity. Up to 75% of its assets are invested in broad domestic and international large and small-cap stocks in developed and emerging markets. The remaining assets are allocated to fixed income (25%).

The ESG Long-Term Growth Pool has a similar risk and return profile as our existing Active Long-Term Growth pool and will continue to be a diversified portfolio across major global equity markets, with a modest allocation to fixed income. The key difference will be the use of active investment managers who incorporate ESG factors – such as climate change, air quality, labor practices, diversity & inclusion, and shareholder rights – into their selection process.

This portfolio measures favorably across all 17 of the United Nations’ Sustainable Development Goals when compared against its passive benchmark. These 17 goals are designed to end poverty, protect the planet and ensure prosperity for all. This option may be appealing to fundholders who wish to ensure their investment strategy aligns with internationally recognized Environmental, Social and Governance (ESG) standards.

This pool is currently available to FFTC fundholders only, with expansion to supporting organizations – such as FCJC – in the future. For those not yet eligible, please contact your relationship manager or Philanthropy@fftc.org to express interest.

The Passive Long-Term Growth Pool offers a well-diversified investment option using low-cost Exchange Traded Funds. The ETFs provide 75% exposure to global equity markets and 25% exposure to U.S. Fixed Income markets.

The Diversified Long-Term Growth Pool is the model endowment portfolio recommended by FFTC's Investment Committee for donors with long-term investment horizons. This portfolio is broadly diversified, offering domestic and international market exposure while investing in large cap and small cap securities in developed countries and emerging markets. The allocation includes alternative investments, hedge funds and private equity investments to improve the overall risk/return profile of the portfolio.

Due to the illiquid nature of some of the alternative investments, there are liquidity restrictions that will apply on these funds which may affect timing of grant requests. Restrictions on withdrawals apply depending upon the fund balance as follows: less than $1M - available within 90 days; $1M-$5M - 80% available within 90 days, remainder within one year; and greater than $5M - please contact your relationship manager.

Foundation For The Carolinas offers a variety of standard investment pools for funds under management that span the risk-return spectrum from conservative allocations to more growth-oriented investment pools. Funds in excess of $2 million may be eligible for custom investment allocations.

This program allows donors with a minimum fund balance greater than $250,000 to use an approved investment advisory firm to manage their donor advised fund in lieu of selecting one of FFTC's Standard Investment Pools. The FFTC Investment Committee must review and approve all investment alliance managers. The Alliance Manager Program's Investment Policy Statement outlines investment guidelines and policies, including quarterly reporting requirements and annual portfolio reviews with FFTC staff.

For more information, contact Natalie Wolf at nwolf@fftc.org.

Current FFTC Approved Investment Alliance Managers

Alliance Bernstein

Bank of America Private Bank

Bragg Financial Advisors, Inc.

Brown Advisory

Brown Brothers Harriman

Callan Family Office

Carolinas Investment Consulting LLC

Carroll Financial Associates, Inc.

Collwick Capital, LLC

Colony Family Offices

Fifth Third Bank

MBL Advisors

McShane Partners

Morgan Stanley

New Republic Partners

Novare Capital Management

Oppenheimer & Co.

Requisite Capital

Sterling Capital Management

Tocqueville Asset Management

Truist Wealth

UBS

Veris Wealth Partners

Wedge Capital

Wells Fargo

For details on all of FFTC’s standard investment strategies, please click here.

For investment information for Foundation for the Charlotte Jewish Community, visit the FCJC page.

Foundation For The Carolinas does not provide tax, legal or investment advice. The information contained here is general in nature and is not intended to be a substitute for consulting your legal, tax or investment advisor regarding your particular situation. Any performance data is based on past performance and is no guarantee of future results.